Levered Free Cash Flow (LFCF) includes interest expenses and principal debt payments. Is levered free cash flow the same as FCF?.To determine the enterprise value of two companies. Unlevered Free Cash Flow Frequently Asked Questions (FAQs) Having negative numbers doesn’t always mean bad – it’s more important to understand the data and note trends over time. While UFCF presents exaggerated numbers for a business, it can serve as a comparative benchmark for your company.Ĭash flow is estimated irrespective of the capital structure, allowing for direct comparison between your company and others. UFCF formula:EBITDA – Capital expenditures (CAPEX) – Working capital – Taxes LFCF formula: EBITDA – change in net working capital – CAPEX – mandatory debt payments It assumes that all capital and assets belong to the owners

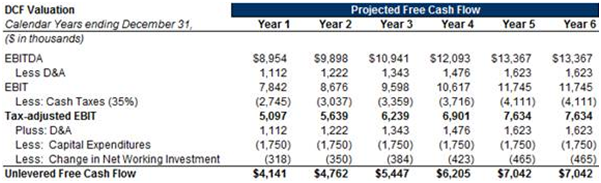

It assumes a business’s capital is borrowed and has debt obligations. UFCF analysis allows the test of different capital structures to determine how they impact a company’s value. If a different capital structure is assumed, the LFCF analysis must be re-run. LFCF analysis considers the capital structure in calculating the company’s Cash flows. It is your company’s money, assuming nothing is paid to equity holders. It is your company’s money after paying off short- and long-term debts. UFCF = 275,000 – 0 – 50,000 – 33,000 = $192,000ĭespite spending more on working capital and taxes, your company records a significant UFCF in the second year because CAPEX is reported in the first year.ĭifference between levered and unlevered free cash flow Levered free cash flow UFCF = EBITDA – Capital expenditures (CAPEX) – Working capital – Taxes Taxes were $25,000 and $33,000 for the first and second years, respectively. In the first year, your working capital was $30,000. You purchased every item your business needs to operate at maximum capacity in the first year, resulting in a $200,000 spend. Taxes: The amount your company owes to regulatory bodies ExampleĪssuming your company recorded an EBITDA of $250,000 in the first year and $275,000 in the second year. Working capital: This is the total current assets – total current liabilities. It also includes accounts payable and accounts receivable. UFCF = EBITDA - Capital expenditures (CAPEX) - working capital - TaxesĮBITDA = Earnings before Interest, Tax, Depreciation, and Amortization: Companies used EBITDA to determine overall financial performanceĬapital Expenditures = CAPEX are cash investments in property, buildings, machines, equipment, and inventory. When calculating UFCF, you consider EBITDA.

#Levered vs unlevered cash flow formula how to#

How to calculate unlevered free cash flow Technically, it is the cash flow that shareholders would have access to from your business operations.Įssentially, the UFCF number is an exaggerated number of your business’s worth if there are no debts. However, the money excludes all operating expenses, capital expenditures, and investments in working capital.Īlso known as Free Cash Flow to the Firm (FCFF), you use UFCF in financial modeling to determine your company’s enterprise value. This is the cash your business has from cash flow activities, including debts. Some investors prefer to use FCF or FCF per share over earnings or earnings per share as a measure of profitability because these metrics remove non-cash items from the income statement.įCF = Operating cash flow – Capital expendituresįCF = Net income + non-cash expenses - increase in working capital - capital expenditures What is unlevered free cash flow (UFCF)? Free cash flow is your company’s cash after paying its operating expenses and investing in capital expenditures.įree cash flow measures your company’s profitability, excluding the non-cash expenses of the income statement on the balance sheet.

0 kommentar(er)

0 kommentar(er)